Tax Navigation by PaperWerks

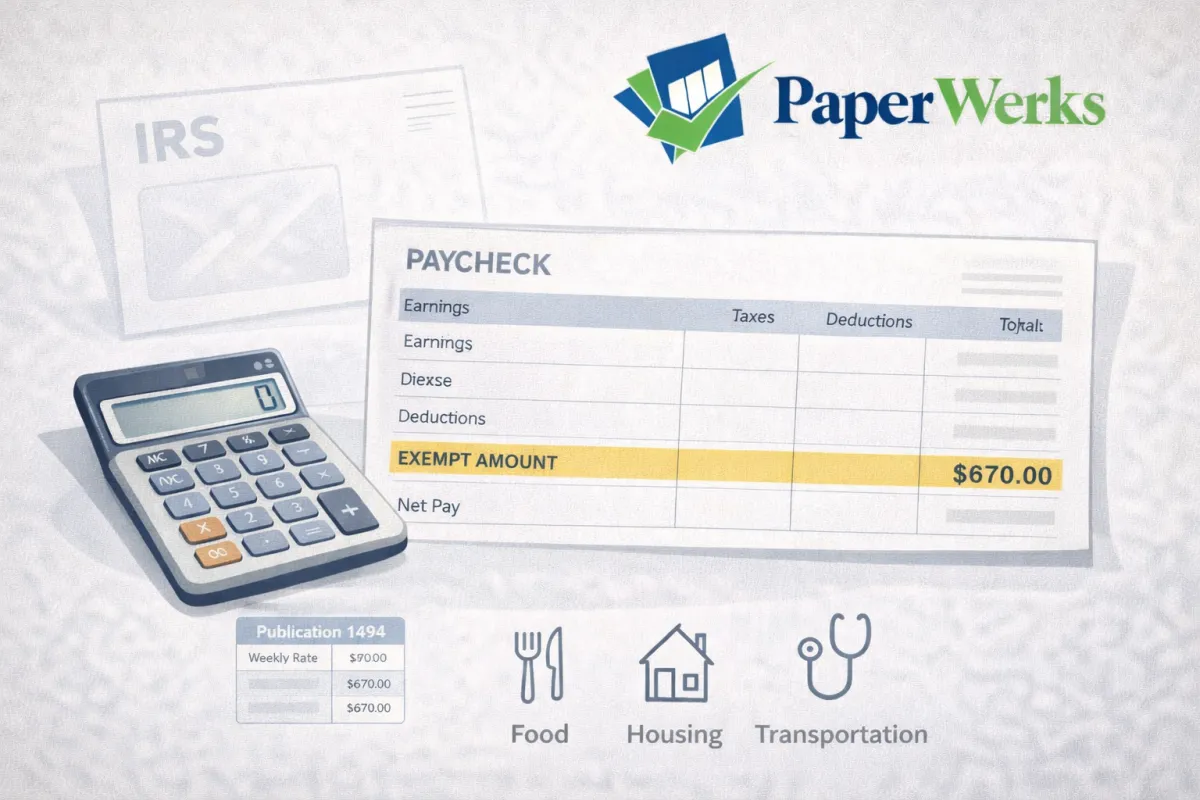

IRS Wage Levies: What Income Is Exempt (and How It’s Calculated)

An IRS wage levy doesn’t always take your entire paycheck. This guide explains how the exempt amount is calculated, including pay periods, filing status, dependents, existing payroll deductions, child support exemptions, and what employers must do when they receive a levy notice.

Federal Tax Liens, IRS Levies, and What They Can (and Can’t) Take

Tax lien vs. levy explained: how federal tax liens arise, what an NFTL means, appeal rights, release vs. withdrawal, discharge and subordination options, property the IRS generally can’t seize, wrongful levy claims, and passport certification for seriously delinquent debt.

What the IRS Can Do to Collect Unpaid Taxes (and What to Do If You Get a Bill)

Learn the key actions the IRS can take to collect unpaid taxes, including timelines for assessment and collection, how interest accrues, payment options, and the difference between collection appeals and collection due process—plus what to do if you agree or disagree with an IRS bill. (Educational only, not tax advice.)