Tax Navigation by PaperWerks

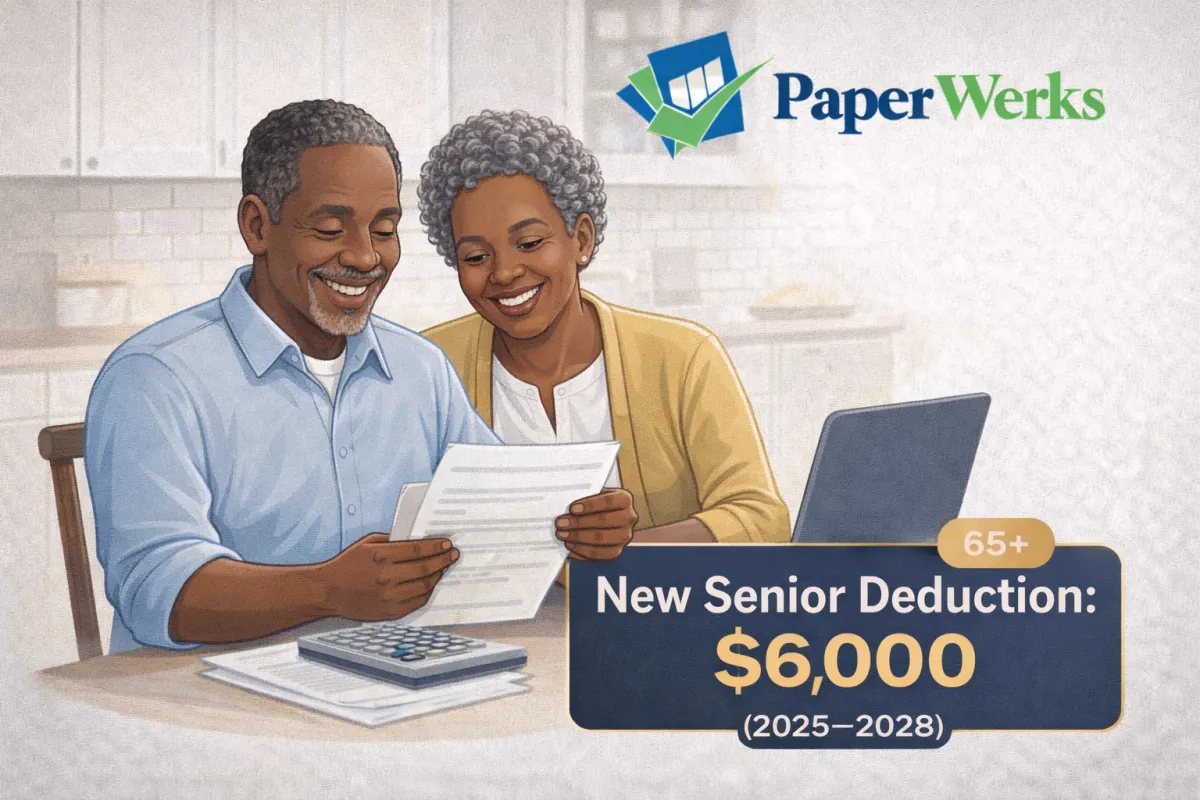

New Senior Deduction (2025–2028): What Taxpayers 65+ Need to Know

Learn how the temporary $6,000 senior deduction (2025–2028) works, who qualifies at age 65+, how the MAGI phaseout applies, and how it stacks with the additional standard deduction.

New for 2025–2028: The Qualified Passenger Vehicle Loan Interest Deduction (Up to $10,000)

Learn about the new 2025–2028 deduction for qualified passenger vehicle loan interest—up to $10,000—plus income phaseouts, vehicle eligibility rules, and what you need to claim it.

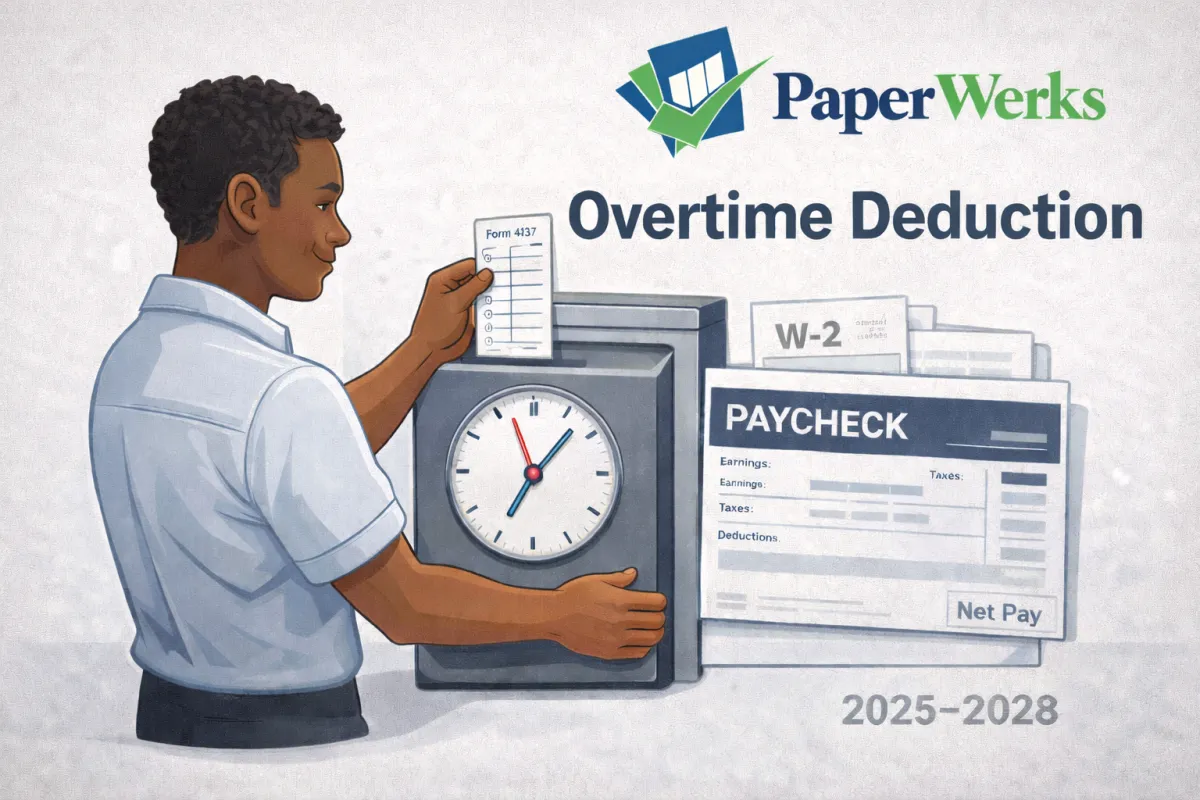

New Deduction for Qualified Overtime Pay (2025–2028): What to Know

Learn about the new deduction for qualified overtime pay available for 2025–2028, including limits, phaseouts, eligibility rules, and W-2/1099 reporting requirements.

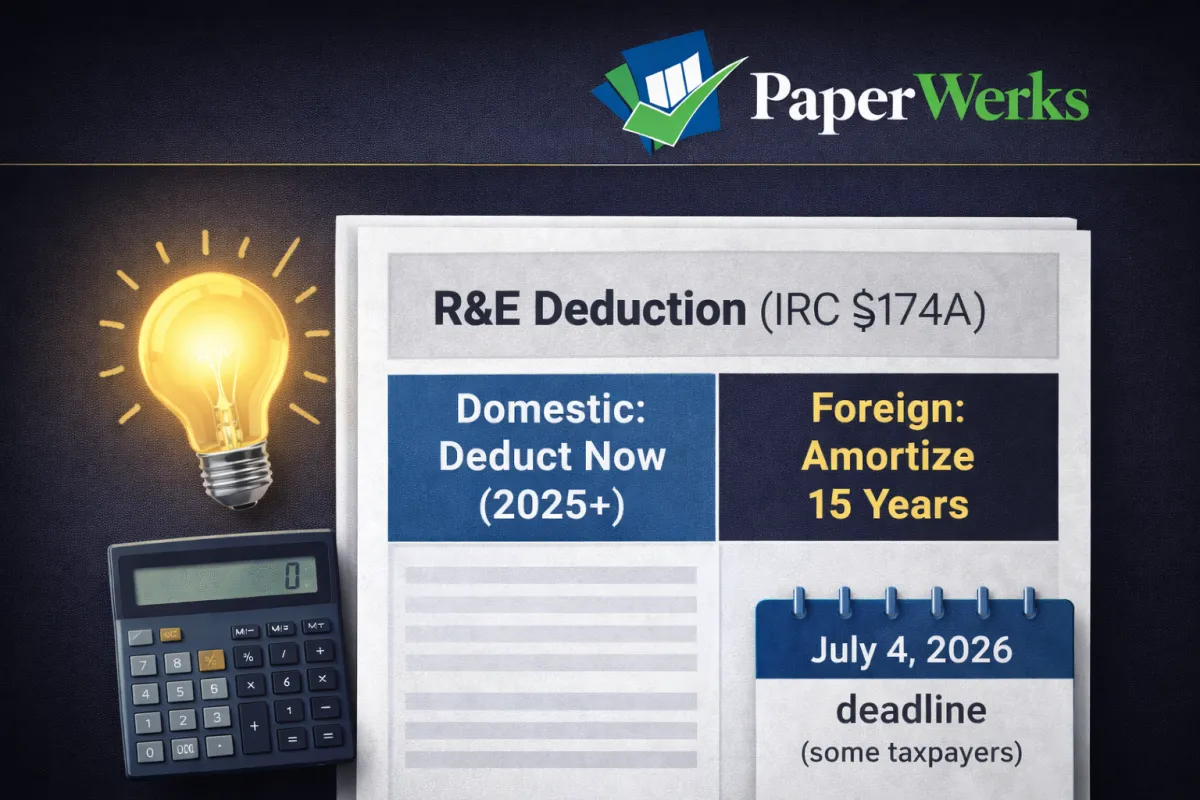

When Can You Deduct Research & Experimental (R&E) Expenses? Key Updates for 2025+ (IRC §174A)

A plain-English overview of the post-2024 updates to deducting domestic research and experimental (R&E) expenditures under IRC §174A, including elections to amortize, foreign research amortization rules, the research credit interaction, and key small-business deadlines.