Tax Navigation by PaperWerks

Trust Fund Recovery Penalty (TFRP): Who Can Be Held Personally Liable for Unpaid Payroll Taxes

A practical overview of the IRS Trust Fund Recovery Penalty (TFRP), including who may be deemed a “responsible person,” how the IRS defines willfulness, what Form 4180 interviews involve, and why responding to Letter 1153 within 60 days is critical.

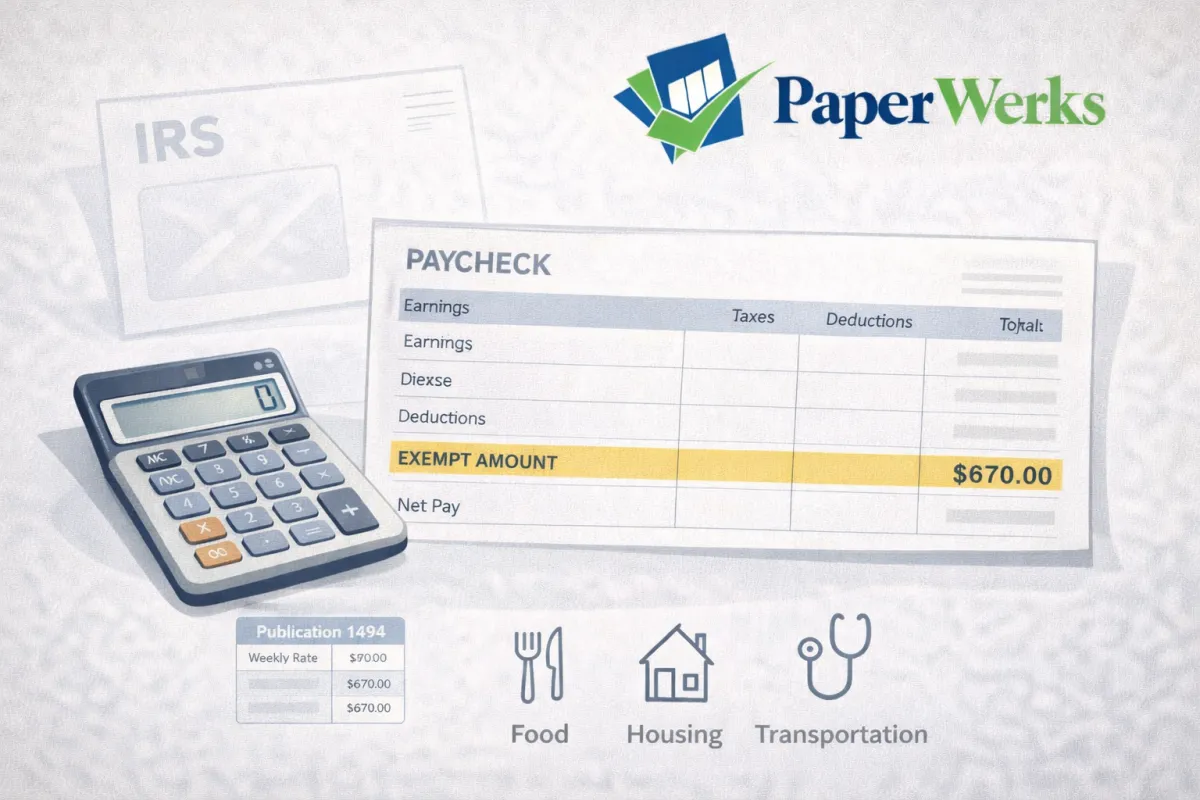

IRS Wage Levies: What Income Is Exempt (and How It’s Calculated)

An IRS wage levy doesn’t always take your entire paycheck. This guide explains how the exempt amount is calculated, including pay periods, filing status, dependents, existing payroll deductions, child support exemptions, and what employers must do when they receive a levy notice.

IRS Collection Financial Standards: How Allowable Living Expenses Are Determined (and Why It Matters)

A practical overview of IRS Collection Financial Standards and how the IRS determines “allowable living expenses” using national and local standards for food, healthcare, housing, utilities, and transportation—plus a quick explanation of the six-year rule.

Federal Tax Liens, IRS Levies, and What They Can (and Can’t) Take

Tax lien vs. levy explained: how federal tax liens arise, what an NFTL means, appeal rights, release vs. withdrawal, discharge and subordination options, property the IRS generally can’t seize, wrongful levy claims, and passport certification for seriously delinquent debt.